Asia-Pacific Property Markets Show Resilience with Rising Investment

The Asia-Pacific commercial real estate sector is witnessing a much-anticipated revival in 2025, with investment in the region experiencing a significant uptick. According to the latest insights from the commercial real estate consultancy CBRE, total investment volume soared 16% quarter-over-quarter, reaching $38.1 billion in the third quarter of 2025. This resurgence reflects a robust mix of cyclical recovery and structural advantages that are nurturing investor confidence.

Investment Trends and Economic Expectations

CBRE’s recently published 2025 Asia Pacific Investment Strategies Report emphasizes favorable conditions for real estate investors. Countries like Japan, India, and Singapore are particularly noting increases in both cross-border and domestic transaction activities, signaling potential for significant returns amid current economic dynamics. Notably, CBRE has revised its growth forecast for the Asia-Pacific region's GDP from 4.1% to 3.7%, attributing slower projections partially to fluctuating trade relationships, predominantly influenced by U.S. tariffs.

What’s Driving the Revival?

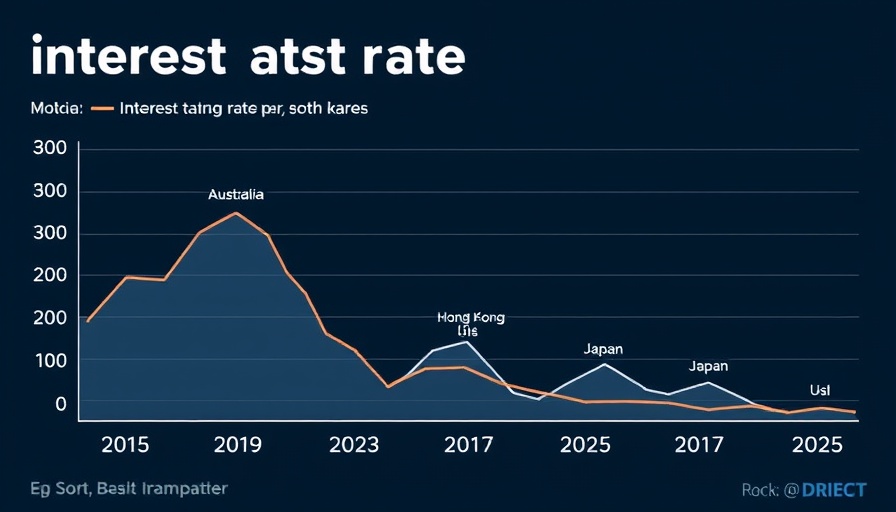

Several factors contribute to this upturn in investment. The shift in monetary policy across Asia Pacific, wherein interest rates have begun to decline, is significantly impacting borrowing costs and spurring renewed investor interest. As borrowing becomes cheaper, more commercial property owners are opting to refinance their existing loans rather than selling off assets in a recovering market. This trend is especially pronounced in economically resilient countries like Australia and South Korea, where positive carry territories are becoming common.

Focus on Office and Logistics Sectors

Among the different property types, offices in Japan and India are emerging as attractive opportunities for investors looking for stability and rental growth. The demand for quality office spaces, particularly near public transport, remains strong despite divergent trends in centralized versus decentralized urban environments. Similarly, logistics and industrial sectors are on the rise, bolstered by the expansion of e-commerce and manufacturing activities in Southeast Asia and India. Institutional buyers are particularly favoring modern logistics facilities that meet the demands of an increasingly digital economy.

Retail Market Dynamics

While the Asia-Pacific retail market shows signs of recovery, performance remains uneven as consumer sentiment adapts to economic uncertainties and trade headwinds. Retailers are increasingly cautious, yet localized dynamics—such as population growth in Australia and heightened tourism in Japan—are expected to stimulate gradual rental increases into 2026.

Looking Ahead: New Opportunities in the Living Sector

As investment in residential living sectors, including multifamily and student accommodations, increases, the pressure for affordable housing grows. Markets like Japan show particularly low vacancy rates—an attractive quality for investors. The rising interest in development projects focused on easing housing shortages in places like Australia signifies a long-term commitment to strengthening residential properties.

Conclusion: A New Dawn for Asia-Pacific Property Markets

The evolving investment landscape across Asia-Pacific stands as a testament to the region's ability to adapt to global challenges and seize new opportunities. With declining interest rates paving the way for strategic acquisitions and robust demand patterns emerging, now is the time for property owners and investors to be vigilant and capitalize on the momentum within this revitalizing sector.

Add Row

Add Row  Add

Add

Write A Comment